THE GROUP

AUM

€ 2.2 billions*

ESTABLISHED

2012

INVESTORS

over 150

PROFESSIONALS

90

*Historically raised

Green Arrow Capital (GAC) is one of the leading Italian Asset Managers.

GAC is focused on alternative investments and operates in the real economy through four main investment strategies: Energy & Digital Infrastructure, Private Equity, Private Credit and Real Estate aimed at protecting invested capital and generating stable long-term returns.

The Group is founded on three core principles – Innovation, Reliability and Sustainability – that underpin our beliefs and reflect vast and varied experience of its partners. Early movers in the renewable energy sector and nimble dealmakers, our word has been our bond and ESG connotation was embedded in our business long before we formally adhered to UN PRI principles.

Founded in 2012, Green Arrow Capital grew rapidly to establish itself as a sustainable return specialist, bringing to market investment strategies designed to protect invested capital and generate sustainable returns, both financial and in terms of ESG goals.

We strongly believe in the alignment of the Group’s interests with our clients’ and our investment teams demonstrate such a commitment by investing in funds they manage alongside our investors.

The cornerstone of the group’s strategy was the launch of the Luxembourg-based Radiant Clean Energy Fund that has a successful investment and dividend-distribution track record. The acquisition of Quadrivio Capital SGR (now Green Arrow Capital SGR) in 2018 represents the second big step towards the strategic growth of the group, followed in October 2019 by the acquisition of Quercus Asset Selection Sarl, an important additional contribution to the growth of the Green Arrow group. Despite the difficulties of the global pandemic situation, in 2020 Green Arrow Capital achieved two further very important steps in the group’s strategic path with the entry of the Intesa SanPaolo Group into the holding’s share capital and with the first closing of the Green Arrow Infrastructure of the Future fund (GAIF) which anticipates the targets of the European green deal. Our Key differentiation factors are Innovation, Reliability and Sustainability.

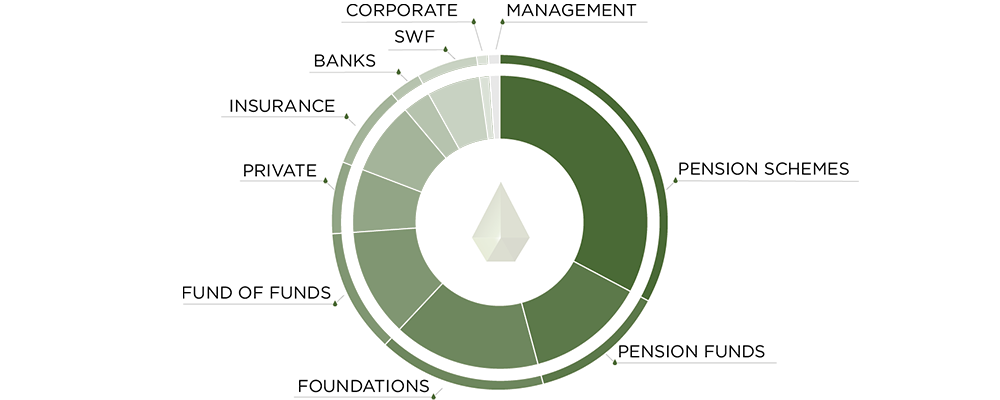

INVESTORS BY CATEGORY

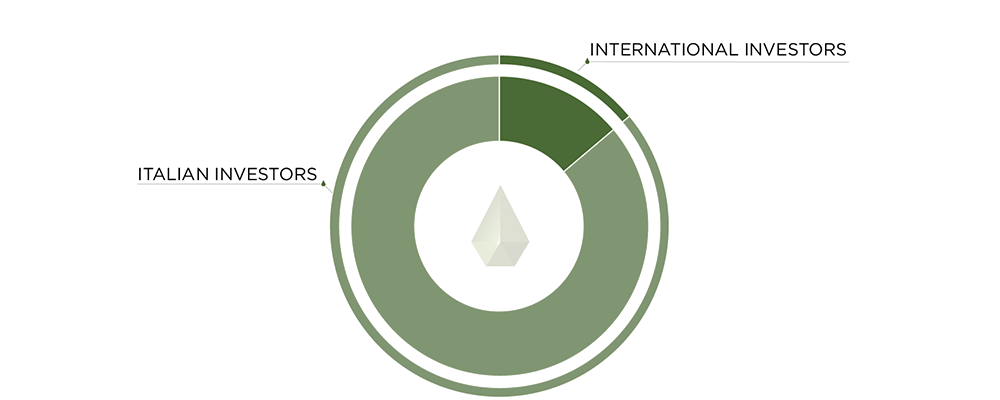

INVESTORS BY GEOGRAPHY

ENERGY

& DIGITAL INFRASTRUCTURE

10 funds (renewables)

1 fund (infrastructure)

PRIVATE

EQUITY

4 funds (buy out/growth)

2 fund of funds

1 fund (turnaround)

PRIVATE

CREDIT

2 funds (direct lending)

1 fund (microfinance)

REAL

ESTATE

1 fund (residential)